Contents

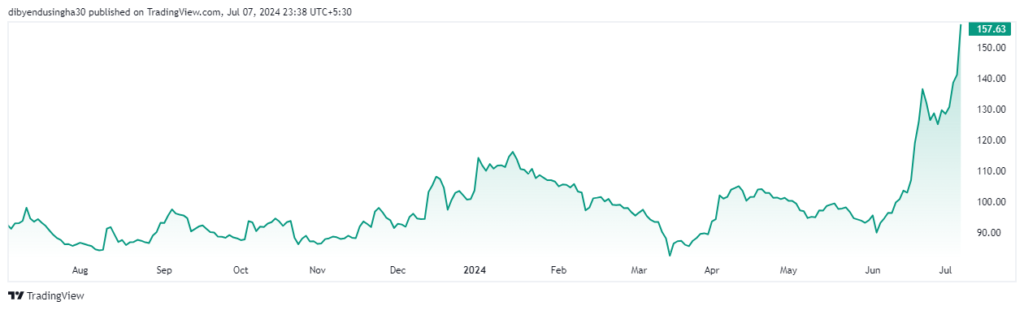

Bhansali Engineering Polymers Ltd (BEPL) is currently trading at ₹157.63 per share. The stock has shown significant growth recently, increasing by 11.62% in the past 24 hours and by 25.50% over the past week (TradingView) (NSE India).

Key financial metrics for BEPL include:

- PE Ratio: 21.83, indicating the stock might be overvalued relative to its earnings (https://ticker.finology.in/).

- Return on Assets (ROA): 16.19%, which is a good sign of the company’s ability to efficiently generate profit from its assets (https://ticker.finology.in/).

- Return on Equity (ROE): 18.09%, suggesting strong profitability from shareholders’ equity (https://ticker.finology.in/).

- Debt to Equity Ratio: 0, indicating the company has no significant debt (https://ticker.finology.in/).

- Dividend Yield: 2.54% with a recent dividend of ₹4 per share (https://ticker.finology.in/) (Business Standard).

BEPL’s recent stock performance has been notable:

- 1 Week: +21.52%

- 1 Month: +69.40%

- 3 Months: +55.30%

- 1 Year: +70.50% (Business Standard).

For more detailed information, including financial reports and real-time updates, you can visit sources like NSE India, Business Standard, and TradingView (NSE India) (https://ticker.finology.in/) (Business Standard).

Determining whether Bhansali Engineering Polymers Ltd (BEPL) is a good buy involves considering various factors, including the company’s financial health, market performance, and industry trends. Here are some key points to consider:

Positive Indicators

- Recent Stock Performance:

- BEPL has shown substantial growth recently, with a 69.40% increase in the last month and a 70.50% increase over the past year (Business Standard).

- Financial Health:

- Return on Assets (ROA): 16.19%, indicating efficient asset utilization (https://ticker.finology.in/).

- Return on Equity (ROE): 18.09%, showing strong profitability relative to shareholder equity (https://ticker.finology.in/).

- Debt to Equity Ratio: 0, suggesting no significant debt, which reduces financial risk (https://ticker.finology.in/).

- Dividend Yield:

- The current dividend yield is 2.54%, with a recent dividend of ₹4 per share (https://ticker.finology.in/) (Business Standard).

- Market Position:

- BEPL is a leading manufacturer of thermoplastic compounds with a strong reputation in both domestic and international markets (https://ticker.finology.in/).

Considerations

- PE Ratio:

- BEPL’s PE ratio is 21.83, which could indicate that the stock is overvalued relative to its earnings (https://ticker.finology.in/).

- Sales Growth:

- The company has reported a revenue growth of -10.335%, which is a negative indicator of growth performance (https://ticker.finology.in/).

- Market Volatility:

- BEPL has a high volatility rate of 16.85%, which may imply higher risk (TradingView).

Industry and Market Trends

- The polymer industry is cyclical and can be influenced by various factors including raw material prices, economic conditions, and technological advancements. Keeping an eye on these trends is crucial for making an informed decision.

Analyst Recommendations

- According to various sources, BEPL has shown strong technical indicators and has been recommended as a stock to watch for potential breakout ranges and support formations (TradingView) (NSE India).

Conclusion

BEPL shows strong financial health, no debt, and good profitability ratios, making it an attractive option for investors. However, the high PE ratio and negative sales growth are points of concern. The recent stock performance has been impressive, but the high volatility suggests potential risk.

As always, it’s important to do thorough research, consider market conditions, and possibly consult with a financial advisor before making investment decisions.