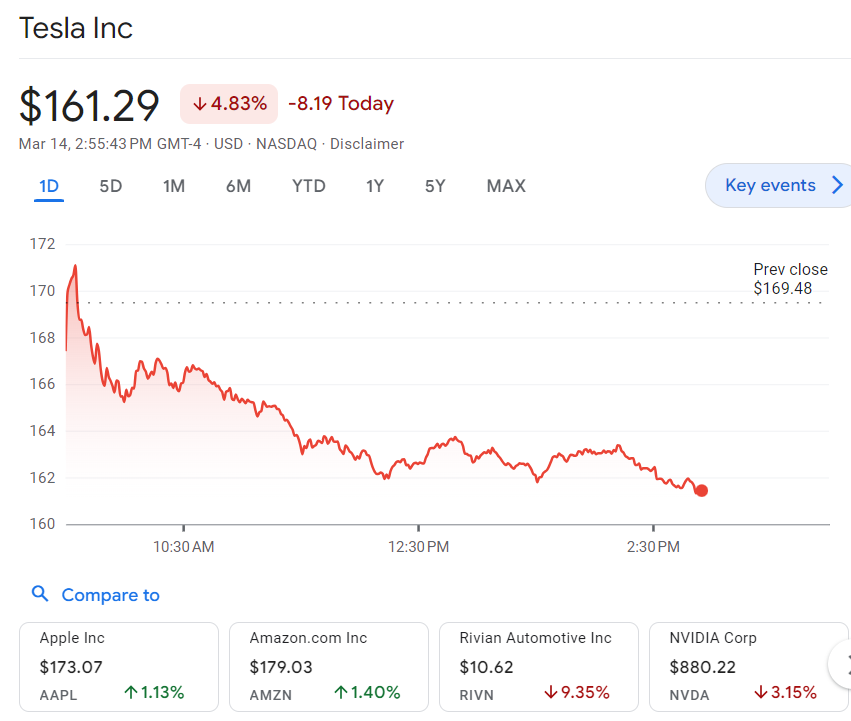

Elon Musk’s Tesla when stood for the future of automaking. Currently the company’s own future is in question. The as soon as heated electrical lorry manufacturer– proclaimed as part of the supposed Amazing 7 leviathan technology stocks– is currently the most awful entertainer in the S&P 500 this year, down virtually 32% given that January. The tale of Tesla’s (TSLA) decrease has actually been well recorded. The business has been plagued by safety issues and remembers, reducing development and has actually even been required to reduce prices. Yet a brand-new record by Wells Fargo analyst Colin Langan on Wednesday uses a darker picture than previously imagined. Tesla, he wrote, is a “growth firm without development.” Langan forecasts that Tesla’s growth will certainly continue to be flat this year and then decline in 2025 as competitors rises, shipments let down and the beleaguered vehicle and technology company is required to cut prices again. UBS likewise reduced its forecast for Tesla on Wednesday.

Experts claimed issues are mounting as need for electrical vehicles reduces and as Chinese competitors take an ever greater share of the international market. With the exception of Tesla, all of the Stunning Seven business (that additionally includes Apple, Amazon, Meta, Google, Nvidia and Microsoft) saw double- or triple-digit incomes development in the final three months of 2023. Tesla reported a 40% decrease in benefit from the year before. Tesla has been browsing with an excellent tornado. The EV setting is obtaining extra congested right as the company’s principles have actually entered into concern. Its share price has gone down regarding 60% from its 2021 all-time high of $407. But despite having the recent decrease in cost, Tesla’s stock is still extremely costly when compared to its actual incomes and profits, said Langan. The company’s former tendency for fast growth is no longer specific, he said, and shares likely have better to drop. Wells Fargo has actually decreased its cost target for the stock from $200 to $125, predicting an additional 25% decline in value. UBS, on the other hand, has actually reduced its rate target to a more modest $165 from $225.