TCFC Finance Ltd is a registered non-banking finance company (NBFC) that operates primarily in trading and investments. The company is involved in equity, debt, mutual funds, and real estate investments, along with proprietary securities trading in cash and future segments. TCFC Finance also actively participates in initial public offerings (IPOs) and seeks to balance its portfolio with high-return investments while maintaining safety.

Key Financial Details:

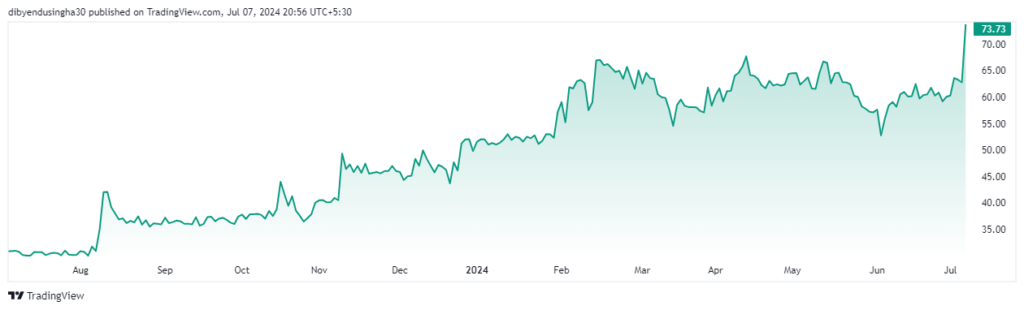

- Current Share Price: Approximately ₹59.70 (as of the latest trading day) (Groww) (Kotak Securities).

- Market Capitalization: Approximately ₹150.88 Crores (Groww).

- 52-Week Range: The 52-week high is around ₹69.50, and the 52-week low is ₹50.00 (Groww) (Kotak Securities).

- Promoters: 68%

- Domestic Institutions: 3.7%

- Public: 28.2% (Kotak Securities).

Technical Indicators:

- Moving Averages:

- 5-Day EMA: ₹60.40

- 10-Day EMA: ₹59.90

- 50-Day EMA: ₹60.50

- 200-Day EMA: ₹53.30

- Relative Strength Index (RSI): 48.81

- MACD: -0.33 (Kotak Securities).

Company Background:

Founded in 1990, TCFC Finance Ltd focuses on capital market opportunities, aiming for long-term growth through strategic investments in equities, mutual funds, and fixed-income securities (Kotak Securities).