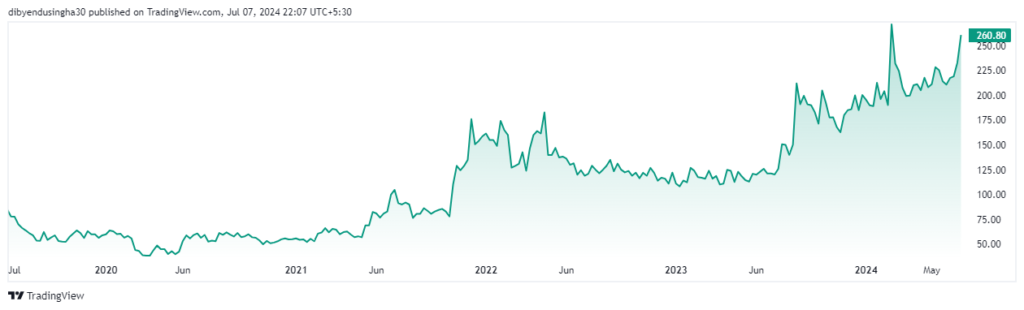

Walchand Peoplefirst Ltd’s share price as of July 7, 2024, is ₹261.00. Over the past year, the share price has increased by 106.57%, with a 52-week low of ₹115.20 and a high of ₹280.80 (ICICIDirect) (https://ticker.finology.in/).

Key Financials:

- Market Capitalization: ₹75.79 Crore.

- PE Ratio: 23.12.

- PB Ratio: 0.34.

- Dividend Yield: 0.43%.

- Debt to Equity Ratio: 0.01.

- Net Profit (2024): ₹3.42 Crore.

Balance Sheet (as of March 2024):

- Share Capital: ₹2.9 Crore.

- Total Reserves: ₹22.89 Crore.

- Total Liabilities: ₹32.59 Crore.

- Total Assets: ₹32.59 Crore.

Company Profile:

Walchand Peoplefirst Ltd is involved in talent development and consulting, specializing in soft skills training such as leadership and communication. The company operates in partnership with Dale Carnegie Training, offering programs across 217 locations in 21 states in India (mint) (https://ticker.finology.in/).