Contents

Emcor Group Inc. (EME) is a leading provider of construction and facility services in the United States and the United Kingdom. Here’s a breakdown to help you analyze EME stock:

Strengths:

- Diversified Services: Emcor offers a wide range of services across various sectors, including construction, building maintenance, and energy solutions. This diversification helps mitigate risks from any single market downturn.

- Strong Market Position: Emcor is a well-established company with a large customer base. Their expertise and experience position them well in the competitive facility services industry.

- Focus on Sustainability: Emcor is increasingly focusing on energy-efficient solutions, aligning with growing environmental concerns.

Weaknesses:

- Competition: The facility services industry is highly competitive, with numerous players vying for market share. Price pressure and competition for skilled labor can be challenges.

- Economic Sensitivity: Emcor’s business can be impacted by economic downturns that lead to decreased construction and maintenance spending.

- Reliance on M&A: Emcor has grown partly through acquisitions. Integrating new businesses can be complex and lead to unforeseen challenges.

Opportunities:

- Aging Infrastructure: The need for maintenance and renovation of aging infrastructure in the US presents a significant growth opportunity for Emcor.

- Growth in Renewable Energy: The increasing demand for renewable energy solutions could benefit Emcor’s energy services segment.

- International Expansion: Further expansion into new geographic markets could be a driver for future growth.

Threats:

- Changes in Regulations: Changes in government regulations regarding construction and environmental standards could impact Emcor’s operations and costs.

- Shortage of Skilled Labor: The skilled labor shortage in the construction industry could pose challenges for Emcor in completing projects efficiently.

- Technological Advancements: New technologies and automation could disrupt Emcor’s business model in the long run.

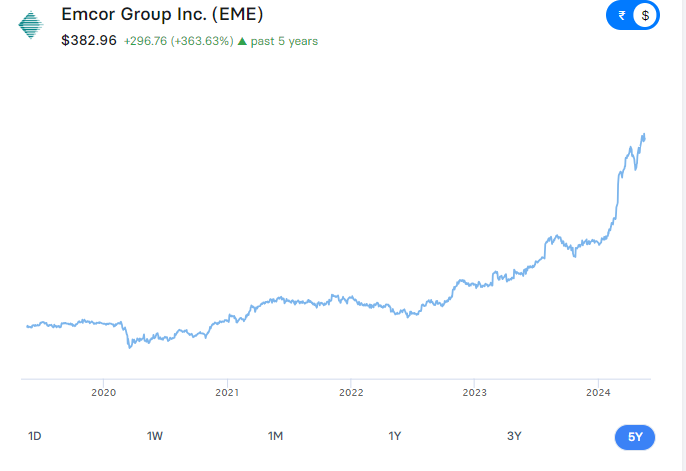

Stock Price Performance:

- Current Price: ~$383.00 (as of May 20, 2024) [Google Finance]

- 52 Week Range: $79.56 – $386.49 (reached a new high on May 16th, 2024) [CNBC]

- Market Capitalization: $18 Billion [CNBC]

Dividend Yield:

- EME offers a relatively low dividend yield, currently around 0.21% [CNBC].

Analyst Opinions:

Analyst opinions on EME stock can vary. It’s recommended to consult multiple sources to get a broader perspective.

Overall:

Emcor Group appears to be a well-positioned company in a growing industry. However, the stock market is inherently risky, so conducting thorough research is crucial before making any investment decisions. Consider factors like your risk tolerance, investment goals, and overall portfolio diversification when evaluating EME stock.