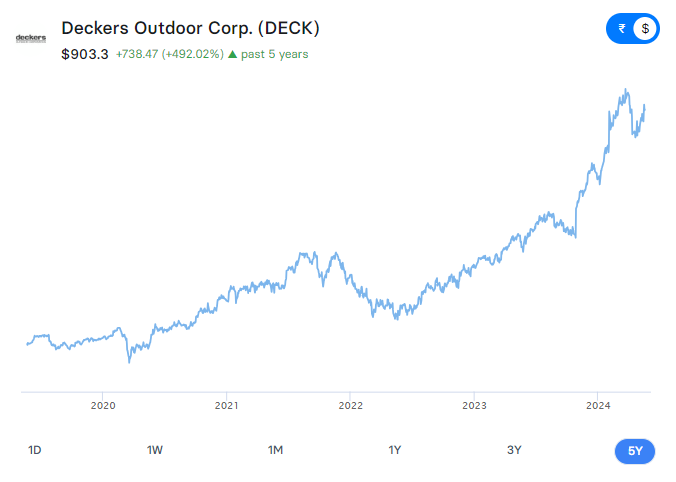

Current Price: $888.56 (as of May 20, 2024)

Recent Performance:

- 1 Day: -0.32%

- 5 Days: +2.34%

- 1 Month: +11.42%

- 6 Months: +38.01%

- 1 Year: +32.93% (YTD)

Analysis:

- Strengths:

- Deckers boasts a strong brand portfolio with popular names like Ugg, Hoka One One, and Teva. These brands have name recognition and loyal customer bases, creating a strong foundation for future sales.

- The company has a strategic focus on growing its e-commerce sales channel. This aligns well with the increasing shift towards online shopping and can help DECK reach a wider customer base.

- Deckers has demonstrated consistent revenue and profit growth over the past few years. This track record of financial performance indicates strong business fundamentals and effective management strategies.

- The company’s return on equity (ROE) of 37.37% is a strong indicator of its ability to generate profits from shareholder investments [CNBC]. This suggests DECK is efficiently using its capital to create value for shareholders.

- Weaknesses:

- The current P/E ratio of 31.96 [CNBC] indicates a high valuation for DECK stock. This could be a sign that the stock price already reflects future growth expectations, leaving less room for significant stock price appreciation in the near future. Investors should be mindful of this and factor it into their investment decisions.

- Deckers, like many retail companies, is reliant on consumer spending. Economic downturns can lead to decreased consumer spending, which could negatively impact DECK’s sales and profits.

- Opportunities:

- The outdoor apparel and footwear market is expected to continue growing in the coming years. This trend presents a significant opportunity for DECK to expand its market share and increase revenue.

- The company can explore expansion into new markets and product categories. This could involve entering new geographic regions, developing new product lines, or acquiring complementary businesses. These strategies can help DECK diversify its revenue streams and mitigate risks associated with over-reliance on specific products or markets.

- The growing focus on sustainability is a trend that Deckers can leverage. By incorporating sustainable practices into its operations and product development, DECK can attract environmentally conscious consumers and position itself as a responsible company.

- Threats:

- Increased competition from other outdoor apparel brands is an ongoing threat for DECK. The company needs to maintain its brand differentiation and innovate to stay ahead of the competition.

- Supply chain disruptions can significantly impact DECK’s production and costs. The company needs to have a robust supply chain management strategy to mitigate these risks.

- Changes in consumer preferences towards different styles or brands can also pose a threat. DECK needs to stay up-to-date on fashion trends and adapt its product offerings accordingly.

- Analyst Opinions:

- The current analyst consensus leans towards a “Buy” for DECK [Markets Insider]. The average analyst price target for the next 12 months is $951.56, representing a potential upside of 7.1% [Alpha Spread]. However, it’s important to remember that analyst ratings are just one factor to consider, and individual analysts can have varying price targets.

- Intrinsic Value vs. Market Price:

- Some analysts believe DECK’s intrinsic value, which is an estimate of its true underlying value based on factors like future earnings potential, is lower than its current market price [Alpha Spread]. This suggests that the stock could be overvalued based on this particular valuation method. However, intrinsic value is a subjective measure, and future growth prospects could justify the current market price. Investors should consider different valuation methods and their own risk tolerance before making investment decisions.

Overall:

Deckers Outdoor Corp. is a well-established company with a strong brand portfolio and a history of growth. The company’s focus on e-commerce, consistent financial performance, and high ROE are positive signs. However, the high valuation and reliance on consumer spending are factors to consider. Carefully weigh the risks and rewards before investing in DECK and ensure it aligns with your overall investment goals.